Types of Business Transactions Cash Credit, Internal External

![]()

Business transaction recording helps the assessor evaluate his business income separate from other incomes. The bifurcation helps the assessee file his income tax returns (ITR) for the required period as per the statutory norms. Accounting transactions are a little different because of the way they may be recorded. In the accrual method of accounting, transactions are recorded once the work has been completed and the goods or services delivered, regardless of whether payment has been made yet. But in the cash accounting method, transactions are recorded only when money is received or paid. Pending transactions are those that have been made but aren’t posted to your account.

ICICI Bank credit card: Changes in reward points, transaction fees, lounge access terms; check details

Although it may seem like a difficult process, once you break it down into its parts, it becomes clearer. The types of information required for making a transaction typically depend on the type of transaction being conducted. However, common types of information required may include name, address, payment details (e.g. credit card or bank account), and contact details.

What are the 4 types of transactions with examples?

Another way to define a business transaction is as any economic event with a third party, which can then be recorded as an accounting item. Business transactions must be measurable in money, or some other quantifiable value. Acquiring or selling assets, such as real estate, machinery, or vehicles, involves significant business transactions that affect the organization’s capital structure. Obtaining loans or entering into credit agreements constitutes business transactions. The influx of capital through loans affects the company’s financial position. For tax reasons, the cash basis of accounting is available only if a company has an average of less than $26 million over the prior three years in annual sales.

Step 2 of 3

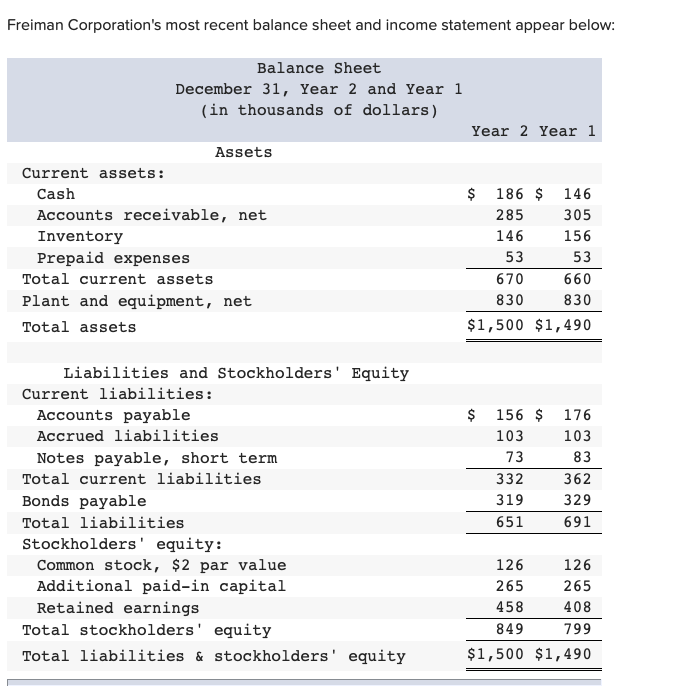

- Business transactions are recorded through a thorough book-keeping process involving journal entries, ledger accounts, trial balances, income statements, and the balance sheet.

- Generally, you need to input all transactional data for each transaction in a system, such as a book or a journal.

- It is not a transaction as it will not change the financial position of the business.

- If the pastry company offers a dozen macarons to a professional photographer for product photos for the company’s website, this is also a purchase transaction.

The cash basis is easier than the accrual basis for recording transactions because no complex accounting transactions, such as accruals and deferrals, are necessary. Its drawback is that the profit of the business may vary wildly from month to month, at least on paper. how to report backdoor roth in turbotax Most small businesses, especially sole proprietorships and partnerships, use the cash accounting method. With this method, income is recorded when payments are received from customers. It is crucial for a business to keep accurate up to date financial records.

How to set up your business: Sole trader or limited company

It is a transaction because it will change the financial position of the business. Cash will decrease by $12,000 and salaries (expense) will increase by $12,000. Another instance of common business transaction disputes involve customers and the shipment of goods, or the provision of services.

Ask a Financial Professional Any Question

Importantly, when payments are made using credit cards or checks, these are also considered cash transactions. Every business transaction must be measurable in monetary terms, allowing for the quantification and recording of the transaction in the accounting records. Transactions that cannot be measured in monetary terms are not recorded.

Continual learning and adaptation to evolving financial practices are crucial for staying ahead in the dynamic world of business transactions. Business transactions are the transactions entered by the assessee for the business purpose with the third party; measured into monetary consideration; recorded in the books of accounts of the assessee. The recording of these transactions into the books of accounts of the assessee depends upon the documents related to the event, which provide proper support to justify the transactions.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch.

Any event that changes the financial position of a business concern and that must be recorded in the books of accounts is called a “transaction“. Also, some transactions are supported by source documents such as invoices but there may be business transactions that are implied and may not be directly supported by source documents. There are also transactions where it might seem you could call it either way, like the CEO’s speech that results in increased company sales in the college town where it was given.

Carefully review all terms and conditions of the transaction to ensure you understand all legal implications, negotiate terms that are favorable and fair, and protect your business interests. This is because the capital account is credited when capital increases. Businesses regularly engage in transactions to purchase inventory or raw materials. These transactions impact the cost of goods sold and overall profitability. Internal transactions, on the other hand, occur within the organization. These may involve transfers between departments, adjustments, or reallocations of resources within the company.