CPA Fees in 2020 How Much Does a CPA Cost? Prices, Rates Per Hour, Fee Schedule

Comparing costs and benefits may not be as straightforward as you think. You can create different scenarios, such as hiring someone to manage accounting software or hiring an accountant for special projects. Compare different Certified Public Accountants (CPAs) based on their expertise, experience, and pricing models. Request quotes from multiple CPAs and choose one that offers competitive and transparent rates without compromising quality. It is important to find a CPA who understands your financial situation and can provide tailored solutions to meet the specific needs of your business.

Alternatives to CPA Services

If accounting makes you miserable, the issue can spread to other parts of your operations. Your ability to lead employees, serve customers, and make decisions could suffer. You don’t want to cut corners, but you should look for cost-effective solutions that fit your business’s needs. Rieva has over 30 years of experience covering, consulting and speaking to small businesses owners and entrepreneurs. She covers small business trends, employment, and leadership advice for the Fundera Ledger. She’s the CEO of GrowBiz Media, a media company specializing in small business and entrepreneurship.

Is it worth it to hire a CPA?

Overhead expenses are costs that do not directly turn into a profit. Though these costs do not convert into cash, they are necessary for running your business. Certified public accountants are usually in demand, and a good CPA can pull in a high five-figure salary.

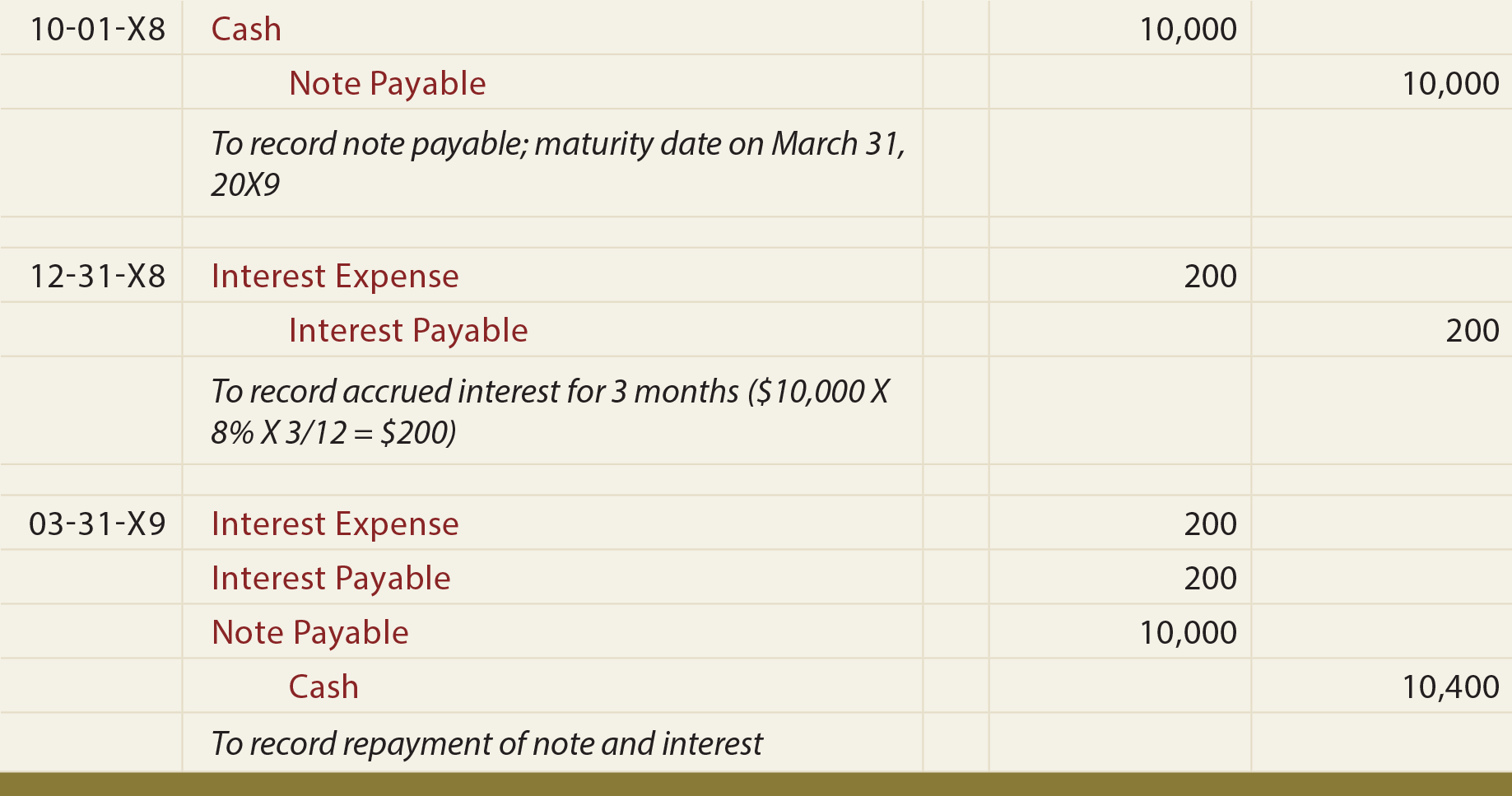

- Some CPAs use an individual fee schedule, which is simply a list of each type of function and how much each costs.

- These services address various business needs, including cost control, risk management, and strategic planning.

- CPAs can also help with financial planning, like helping you see potential financial gains and losses.

- Your firm likely has a bookkeeper you can work with throughout the year to keep your books clean.

- When a CPA prepares your tax return, they’re less likely to make those costly mistakes in the first place.

What does an accountant do?

There several accounting software options you can use to run your accounting services. The best accounting software will help track your business income and expenses, prepare taxes and give reports on your financial status. An example is Zoho Books, which offers advanced features, such as time tracking and project accounting. The cost of professional tax preparation services for an LLC can vary based on factors such as location, complexity, and the CPA’s fee structure. On average, LLCs can expect to pay anywhere from $500 to $2,000 for tax preparation services, with more complex tax situations potentially increasing the cost.

- As a small business owner, you probably already do quite a bit of accounting, and you know how hard that work can be.

- § 1.168(i)-6(i)(1) to restart the depreciation on the carryover basis of the property based on the depreciable life of the replacement property.

- With these accounting software platforms, you can handle your accounting activities yourself.

- Though these resources can vary in cost, it’s important for CPA candidates to consider their individual needs and learning preferences when deciding on which resources to invest in.

- Our detailed review of what you can expect to pay in CPA fees covers this exact scenario in the previous section.

Take a look at this average CPA fee schedule from CBS News featuring common occurrences that cost consumers extra money come tax time. We’ve referenced PayScale, which provides current average CPA rates cpa monthly cost and also addresses the question, “How much does an accountant cost? DIY software allows you to import transactions from your bank accounts so you can categorize and track your income and expenses.

How do I report benefits on my W-2 as an S corp owner?

Keeping burn rate in check is vital for the long-term success of your business. Churn rate measures the percentage of customers who stop using your product or service over a given period. This critical metric provides insights into customer satisfaction and product-market fit. A high churn rate can indicate issues https://www.bookstime.com/ with your product, customer engagement, or support, necessitating immediate attention. Comparing CLV with CAC can reveal if you’re spending too much on customer acquisition without receiving sufficient return. A higher CLV than CAC indicates effective customer acquisition strategies and sustainable growth.

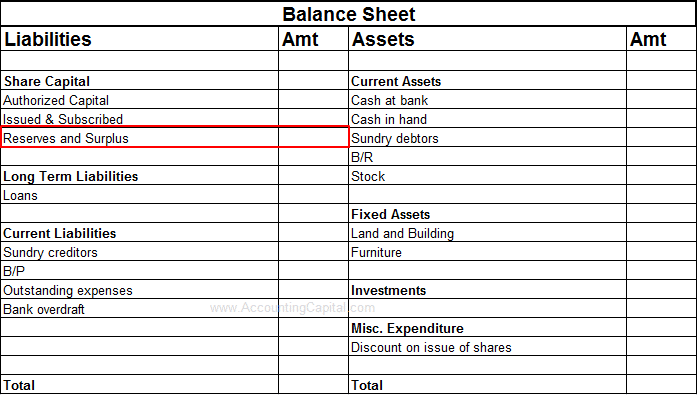

We’ll show you the benefits of hiring an accountant, how to determine their fees and alternatives to hiring one if their cost is beyond your budget. A cost-benefit analysis weighs the benefits and the costs of hiring an accountant by putting a price tag on the pros and cons. This analysis is only an estimate but helps determine if an investment makes sense for your business.

The company they work for and their geographic location also impact their earning potential. You’ve passed the CPA Exam, completed your ethics course, and have your experience documented and signed off by a licensed CPA. Submitting all your information and obtaining your license will come with another fee, which does vary from state to state. If you don’t pass a section of the CPA Exam, you will need to retake it, which means you may have to repay a registration fee and the exam section fee. Before you can apply for an exam section, you’ll need to apply with your state Board of Accountancy to ensure you meet the education requirements. This one-time fee varies depending on your state, but it’s typically between $50 and $200, though it may be as much as $300.

Does your small business need an accountant?

Before GrowBiz Media, Rieva was the editorial director at Entrepreneur Magazine. Practice all four parts of the CPA Exam with the types of questions you’ll see on exam day, written by Becker experts. Still, it makes the most sense for those seeking to climb the corporate ladder and further educate themselves in accounting. It takes time and effort to earn a CPA designation and therefore to earn an attractive CPA salary. Certified public accountants can find work within international financial firms or the government and typically will earn more than an accountant without the designation.

When you own a small business, you’re hands-on – but your time is limited. Even if you wanted to control every aspect of your business, it’s just not a good idea to do so. That’s why you’ll hire a lawyer, your own marketing person, and for many business owners, that also means hiring an accountant. The frequency of engaging a CPA for services, such as monthly, quarterly, or annually, can affect the overall cost.